The accord — now dubbed the United States-Mexico-Canada Agreement, or USMCA– needs to be approved by lawmakers from all three countries, IndustryWeek reports Tuesday, the day after President Trump announced an agreement between the US, Mexico and Canada.

Stocks of U.S. automakers including General Motors Co. rose on Monday after they avoided the prospects of steep tariffs and disruption to supply chain that spans all three countries.

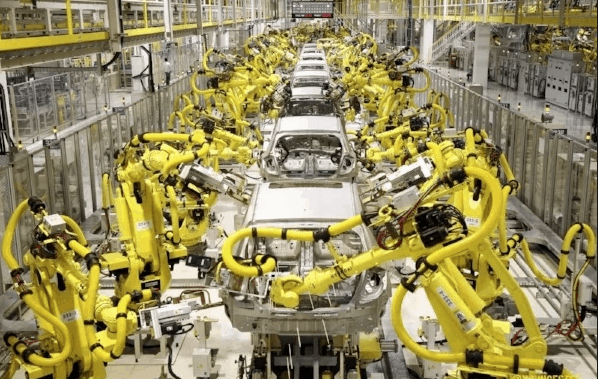

But there are concerns, with some of the biggest changes in the agreement coming in vehicle production. A car must have 75% of its parts come from the region to receive duty-free designation, up from 62.5%. It also requires that at least 40% of a car is made by workers whose pay averages more than $16 an hour, which could push production from Mexico’s cheaper labor market to the U.S.

“New regional value content requirements mean that automakers will not able to source parts as freely, so there will be added costs,” Ivan Drury, senior manager of industry analysis for car-shopping website Edmunds, said in an emailed statement. “Given that new vehicle prices are already stretched to record highs, things could take an ugly turn for consumer wallets.”

The deal could shift auto-parts production, but mostly those used by European and Asian carmakers building vehicles in Mexico for the U.S., said Kristin Dziczek, analyst at the Center for Automotive Research in Ann Arbor, Michigan. But in many cases, foreign carmakers would choose to pay a fine because it would be cheaper than spending to relocate production for big items, like engines and transmissions, that they import into the NAFTA region.

More at Industry Week.