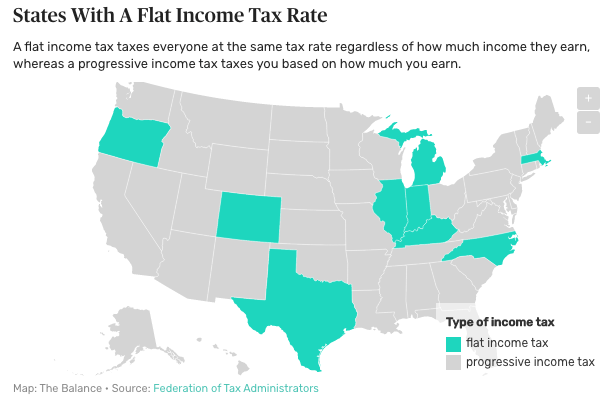

Illinois is one of nine states that has a flat state income tax system. Governor J.B. Pritzker and the Democrat-controlled state legislature agreed earlier this year that Illinois should abandon the flat tax system.

The change will require an amendment to the state’s constitution – and the approval of Illinois voters in the November 2020 election.

Illinoisans are about to become inundated with ads on tv, radio, internet and beyond paid for by the Governor himself. This week, he donated $5 million to launch what they are calling the “Vote Yes for Fairness” campaign – a financial gauntlet being tossed out to intimidate any forces that want to preserve the state’s flat tax system.

By coincidence, an op-ed in the Kankakee Daily Journal written by Illinois Business Alliance’s Jared D. Carl leaped into a public discussion on the topic of flat tax.

Carl argued that Illinois abandoning its roots of flat tax as confirmed in the state’s constitution would be devastating for the state’s economic and job climate. It would cause “capital flight” – something no small or medium sized business wants to happen.

In “Progressive tax will prompt multiple problems,” Carl wrote:

The most immediate effect of Gov. J.B Pritzker’s “Fair Tax” would be capital flight from Illinois.

Illinois is a high-income, high-wealth state, particularly in the Chicago area. Chicago is not only a transportation hub, it’s also a financial center, meaning that there’s a high concentration of investment capital in the Chicago area. Gov. Pritzker’s tax increase would hit Illinois’ investment capital hard, resulting in capital flight, a loss in productivity, fewer jobs and slower income growth.

Capital is famously mobile. As the saying goes, “Capital goes where it is welcome, and stays where it is well treated.”

Data from the Internal Revenue Service breaks out income earned as returns on capital investments that would be hit by Gov. Pritzker’s progressive income tax. The lion’s share of capital gains, ordinary dividends, qualified dividends and taxable interest is earned by investors with more than $1 million of income. Returns on capital also represent significant earnings for those making $250,000 to $1,000,000, according to 2017 IRS data.

Illinois taxpayers achieved $58.8 billion of income in various forms of investment returns from capital gains, dividends and interest in 2017. The “Fair Tax” would hit taxpayers responsible for approximately $3 of every $4 of those capital returns.

In total, $42.8 billion of income went to people who would be affected by the “Fair Tax.” And of that, $30.4 billion went to people who would have their tax rate increased by 3 percentage points for every dollar of income because of the “recapture” provision.

Given the mobility of capital, if the “Fair Tax” passes we can expect marginal investments to relocate outside of Illinois where they can achieve a better after-tax return. We also can expect high net worth investors to relocate out of Illinois in order to have all of their investment returns taxed in a lower-tax state.

Capital goes where it’s welcome. Since the “Fair Tax” is hostile to capital, marginal capital won’t stay in Illinois. Investments based specifically on high-return Illinois business activity that provide strong returns will still be well-justified under the “Fair Tax.” But there are billions more in capital that will relocate from Illinois and never return because of tax planning to avoid Illinois’ uncompetitive and exorbitantly high rates.

In short, the “Fair Tax” would raise tax rates by about 60 percent on mobile investors and their capital, which is responsible for nearly three-fourths of all Illinois’ returns on capital gains, dividends and interest.

The inevitable response will be capital flight as investors seek to avoid Illinois’ uncompetitive tax rates. Marginal investments that can move will, and many high-net-worth individuals who don’t need to be in Illinois will move as well.

Capital is a critical input for economic growth, and it’s the most sensitive to taxes. And let’s not forget that when uncompetitive tax rates incentivize capital reallocation, it’s often the middle class and job-seekers who are left behind and suffer. Gov. Pritzker likes to claim that 97 percent of Illinoisans won’t see a tax increase under the “Fair Tax,” but the reality is that the “Fair Tax” and the capital reallocation that would follow would mean fewer jobs, slower income growth, and fewer economic opportunities for Illinoisans.

The Government Relations Committee of the Technology & Manufacturing Association sides with Carl’s assessment.

More to come …