The taxpayers of Illinois rejected Gov. Pritzker’s Progressive Tax. Where do we go from here?

By TMA President Steve Rauschenberger –

First, let’s examine how the tax battle came to be. It starts with Governor Pritzker.

Imagine for a minute what it would be like, what YOU would be like if you were born a billionaire. It is hard, isn’t it? Most of us pursue education, work, relationships, and interactions to achieve security – economic and social. We are motivated to be productive and successful because we want to achieve that security.

But what if you never had those motivations? What if from the time you could understand money, you were assured you would have more than you could ever spend? What then motivates your life ambitions?

Think about how often a birthright billionaire is told “No” in their adult life. What kind of people surround and work for billionaires? How does a billionaire understand what fears, challenges, and dreams non-billionaires have?

Illinois Governor JB Pritzker never expressed an interest in elective office until he was “recruited” into Democrat politics. His first foray was chasing an appointment to the U.S. Senate seat previously held by then President-elect Barack Obama. We may all remember how well that turned out, or we can hear it on FBI-captured phone conversation tapes.

With his appetite whetted, Mr. Pritzker was importuned by Chicago Democrat operatives as the antidote to then Republican Governor Bruce Rauner – a millionaire himself.

We can only imagine how the wooing might have gone, but I would bet terms such as “savior” “best chance” “critically needed” “perfect for the job” all played a role in the courtship. After all, Pritzker’s sister Penny had finished as the United States Secretary of Commerce in the Obama administration, so it is in Governor Pritzker’s blood.

A couple of hundred million dollars later, and JB is now Governor Pritzker. Like Rauner before him, it seems for a little more than pocket change, he managed to purchase a political party. Granted, the acquisition comes with some baggage and several unsavory characters, but, Pritzker

thinks that can be remedied in good time.

PRITZKER & MADIGAN

Having no political experience or political associates, the newly-minted governor is helpfully staffed by the Democratic Party Chair and long-time Speaker of the Illinois House, Michael Madigan. Surrounding an inexperienced chief executive are the Democrat Party faithful, trained and led by Speaker Madigan.

It is not surprising that the Governor’s agenda and policy directions are similar to the long standing aims of the House Speaker.

Now Governor Pritzker presides like the honorary chairman of Illinois’ largest black-tie fundraising event. He casts his eye about on all of those lesser lights in attendance at his event and silently prides himself on all the generous good he is doing. For his first two years in office, he smiles, he listens, he exhibits compassion, and then he does as he likes (or as his advisors insist he must do). There are few under the Illinois Statehouse dome interested in or willing to argue with him or tell him no. In fact, many have pinned their hopes of advancement and future campaign finances

on his good graces.

Governor Pritzker sets out to right wrongs. He generously waives his salary as governor. After all, why bother with a monthly salary of just over $10,000? Pritzker sees that his staff pay is limited by statute, so he decides to use his own money to double their pay. Ignore, please, the inherent

conflict of interest to which this might lead.

Pay no attention to the impact this act will have when Pritzker must negotiate with the state employees’ union over their wages. Schools need more money, so the teachers’ union says; we will do that. The state colleges and universities need money too – that is important as well. And the elderly, and the disabled, and the sick and the homeless, these are all priorities that must be addressed.

Suddenly, and perhaps for the first time in his life, money problems confronting Pritzker are bigger than his personal net worth. He cannot fix these things by writing a check or calling on a few friends to help. These are real life, really big problems.

Oh my!

The governor rejects out of hand the slow, boring work of evaluating the effectiveness or results of the $43 billion of current state spending. The budgets are already bare bones and can’t be cut, all those around him say. Pension reform is out of the question, the courts have told him so.

The State needs more money, so taxpayers will just have to pay up.

Nearly fifty new taxes and fees and the doubling of the gas tax give the Pritzker Administration a start. How satisfying to expand programs, fulfill needs, and keep promises!

“My, that went well,” he thinks.

The governor can announce new road projects, grants, and program expansions. But it is not enough. It perhaps can never be enough. There are more needs, a backlog of bills on hand, not to mention the current budget deficit and the pension funding problem – all to be dealt with.

GOVERNOR DEMANDS MORE MONEY

What about asking all of the rich, the billionaires, the millionaires, the thousand-aires of Illinois to pitch in?

Surely the successful will understand their obligation to fund what the state employees want, what the teachers’ unions want, what lobbyists and advocates want. How can they not see that it is “noblesse oblige,” their responsibility, to give more of their wealth to fund this grand vision?

Let’s base the income tax on the “ability to pay.” We will gradually increase it to make it “fair.” Everyone will see how fair and compassionate and right that is.

There is a problem, however. The framers of the Illinois Constitution expressly prohibited the implementation of a graduated income tax. Those pursuing a change in the constitution argue it was the framers’ myopic view that a single, flat rate income tax would protect citizens and taxpayers from the spending excesses of the Illinois General Assembly. How thoughtless, “unwoke,” and cynical could they be? They decide passing an amendment to the state constitution would free Illinois taxpayers from their financial prison.

A Fair Tax it will be!

Then comes the election of 2020.

In the middle of a maddening pandemic, with the “evil Orange Man” criticizing Pritzker’s every “stay at home/ shelter in place” order, the referendum on his signature vision must be run on the 2020 ballot.

In the middle of a maddening pandemic, with the “evil Orange Man” criticizing Pritzker’s every “stay at home/ shelter in place” order, the referendum on his signature vision must be run on the 2020 ballot.

Surely everyone will see the wisdom of the governor’s call for a new progressive income tax. And in case they don’t, he publicly pledges to spend an enormous $60 million dollars to tell the voters that they should embrace this new, enlightened, progressive/fair tax.

The Governor chides, warns, and even threatens.

Meanwhile, his political operatives spend money like it has never been spent before to sell Pritzker’s progressive tax. All early signs point to its passage. The proposal’s language on the ballot is slanted his way; they move the question to the top of the ballot. All of his friends in organized labor and the teachers’ unions have promised to help.

Surely, the simple Illinois voter will see the light, hear the message blasted across TV and social media, embrace the greater wisdom that the Governor and his staff have, and trust them with this new taxing authority.

It must be, it should be, it will be…until it is not.

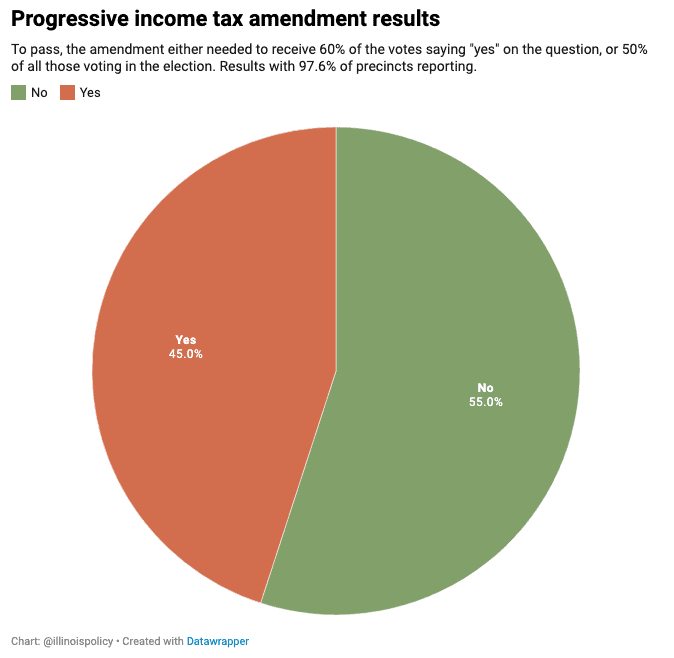

By recent count 2,849,000 or so Illinois voters said “No” to the ballot question. Despite all of his good will, spending, warnings, and cajoling, the majority of Illinois voters (55%) told the Governor resoundingly “No!” for the first time in his governorship.

Pritzker’s immediate reaction to the voters was anger and frustration. He blames, lashes out, and suggests revenge.

The ballot question’s failure is the fault of “fill in the blank.” Those darned Republicans, greedy billionaires, those fat cat business owners that underpay their employees. It is all their fault!

“Now I am going to have to do a lot of stuff I didn’t want to do,” Pritzker thinks out loud.

Cut higher education funding so middle-class parents can feel some pain. Find ways to raise taxes from employers who fought to defeat the hiked tax. Take away their research and development incentives; add taxes to the materials used in production; raise taxes on the energy they use.

“We must have more money,” he says. “Don’t listen to their cries that we are making Illinois manufacturers less competitive. They didn’t help me, so I won’t help them. They always say that we will lose jobs, have less work and less prosperity if we raise taxes. But look around, they are all still here, right?”

Pay no attention to the vacant factory buildings and distribution plants that used to provide jobs on Chicago’s west and south sides.

“And in the end, I am going to raise the unfair flat tax because there is just not enough money in making a few cuts and closing a few loopholes,” he says.

WHAT ABOUT THE GENERAL ASSEMBLY?

Think about 177 elected members of the Illinois General Assembly. For many, perhaps most, their office is the capstone of their careers. The majority ran for office to “change” Illinois, but few can tell you into what they want to change it. Most of these 177 elected officials had to receive the blessing of their party bosses to win their seats. The majority of them relied on their political parties to finance their election campaigns. The party boss with the most seats under his control, with the most money to finance races, and with the most clout in Illinois is Democrat Party Chairman and House Speaker Michael Madigan.

Very few of these elected representatives were raised up by their communities to go to Springfield to represent then. They are not independent, intellectually grounded, citizens determined to protect their constituents and communities from the clumsy hand of state government. For the most part, these are political creatures, more dedicated to their careers and those that further those careers than they are to the voters they putatively represent.

They are free to advocate, give speeches, introduce bills, question bureaucrats, host fundraisers, run golf outings; but when it comes to voting on issues of substance like the enactment of the state budget, they exist on a very short leash.

Consider that we are more than nine months into the COVID crisis.

For more than 270 consecutive days, the citizens of Illinois have been subject to the rule of a single man without color of law. The governor unilaterally decided that his 30-day emergency authority will last as long as he wants. Literally millions of Illinois workers have been laid off, let go, or had their work hours curtailed.

Hundreds, perhaps thousands, of small businesses have been ordered to shutter by the State, then told they can reopen only to do what the Governor decides is safe. People can’t pay their rents, landlords can’t pay their mortgages, small businesses are being forced into bankruptcy, and yet not a single hearing has been held by either the Illinois Senate or House to force the Governor and his Administration to explain their data, decisions, or rationale.

Four years ago, when there was a Legionnaires’ disease breakout at the Illinois Veterans homes, each chamber of the Illinois General Assembly held extensive hearings to force the Rauner Administration to explain what went wrong, and what they were doing about it.

There have been no hearings about Pritzker’s COVID policy because Democrat representatives have been told by powers that be there will be no hearings.

All the Democrats in both the House and the Senate voted for and supported the Income Tax Amendment. Many of them were already negotiating the new spending that the Progressive Income Tax would fund. They planned on the “Blue Wave” and the defeat of Donald Trump to carry the day and pass the ballot question. They are not happy with the results.

Like the Governor, they, too, are in the midst of the blame game. They ask “Who did this to them, who dares to curb our spending ambition, who thinks they can thwart our will?” They say, “Those thoughtless and greedy billionaires, millionaires, shop owners, farmers, factory owners have defeated our new revenue source, and we need to make them pay.”

The Illinois Legislature’s voices have already been raised in anger. If you think Illinois has had anti-business policies in the past, just wait and see what comes next. Their hubris was on display, and now they are angry at being denied.

You hear no reflection from them about misunderstanding their constituents, no awareness that they might be wrong on the policy, no appreciation of the disdain they are held in, no recognition that their own institutional corruption played a large part the failure of the Amendment.

In a healthy state legislature – think Indiana or Iowa or Missouri – lawmakers might take the message that the voters rejected their solution, and search for different ways to approach their problems. The last thing a healthy General Assembly would do is blame the voters and citizens they have taken an oath to represent.

The cooler heads in Springfield are contemplating how dangerous the voters are unless hacked up into legislative districts. With all the advantages – the money, the union support, the promise of a tax cut – their tax amendment was soundly defeated in a politically blue year. Perish the thought of the voters being allowed to vote on redistricting reform, term limits, or pension reform.

Illinois Republican legislators in the super-minority are in a quandary as well.

With a couple of exceptions, they have never chaired a committee, passed a bill without the Speaker’s permission, or been in the majority. They have spent most of their careers pushing the “red button” (no vote), and blaming the Democratic majorities for all of Illinois’ problems. While it might be fair to blame the Democrats, it doesn’t solve any problems and it certainly doesn’t inspire any voter support or enthusiasm. Twenty years of voting “No” has resulted in a 30 percent decrease in Republican-held seats.

So on balance, the Democrats want to blame employers, business people, factory owners and the successful, and the Republicans want credit for voting “No” as the finances of the State of Illinois sink to rival a bankrupt banana republic.

WHAT’S THE ANSWER?

We need as taxpayers, as members of TMA, as citizens of Illinois to claim victory. The “No” vote was a vote against any new taxes. In a Democrat-leaning year, with 60 million dollars of advertising, with every union in the state in support, voters soundly rejected their plan. They were saying, “Do you hear me now?”

Manufacturers, business owners, taxpayers and citizens need to realize that the defeat of the Progressive Tax is not the end. Indeed, it is the end of the beginning.

We are facing the consequences of 20 years of unbalanced, manipulated state budgets. This will not be pretty. It will be a painful process in which to begin to disentangle the necessary from the wasteful, unnecessary, and specious in state spending. There will be a constant and cacophonous shrieking from professional tax eaters. They will not give up the rotting corpse of Illinois’ budget until committed taxpayers drive them away with resolve.

We need to tell every elected official from the city hall to the statehouse it is time for them to control spending, freeze hiring, reduce staffing, eliminate programs, and live within their means. We need to patiently explain over and over again to any elected official that will listen that taxes matter, that taxes have consequences for jobs and prosperity, and that Illinois already has the second highest tax burden in the U.S. We need them to hear from people that live and work in their districts that these taxes and feckless government spending are what is destroying prosperity in Illinois.

We need be serious and resolved. Repairing Illinois’ financial house will take years. Those years will all be challenging. We should not expect those who have personally prospered by wrecking the finances of the state to willing surrender their privilege. But we really have little choice. Either we fight for financial solvency, pension reform, redistricting reform, legislative term limits, and responsible spending or we quietly suffer in desperation until we have no choice but to join the hundreds of thousands of Illinois ex-patriots that have left.

NEXT STEPS

STEP 1: TMA is going to ask each TMA member to sign on to the new “Budget Sanity” coalition, both personally and as a company. We hope to cooperate again with the Illinois Farm Bureau, the Illinois Chamber, and the Illinois Chapter of the National Federation of Independent Business and build a coalition list in the thousands.

STEP 2: TMA will prepare and distribute editable letters to send to your state representative, state senator, mayor or village president and to the chair of your school board and its superintendent.

STEP 3: TMA will ask every association member that is active on social media to assist in the education effort by liking, commenting, and forwarding posts related to the coalition.

STEP 4: TMA will ask members to share taxing and spending information with their employees to continue the education process with their team. We want all TMA member employees to feel comfortable, but also want them to understand that state and local tax policies affect their company and their future.

We have the truth on our side. We have momentum. We have credibility. Now we need to show the will to stay engaged to help lead Illinois to a better place.

Before becoming president of the Technology & Manufacturing Association in 2014, Steve Rauschenberger served in the Illinois Senate as Chairman of the Appropriations Committee.